2021 IRS Whistleblower Program Numbers Fell Flat, But Hope Remains

Sometimes, the numbers speak for themselves. And sometimes, what the numbers say is just plain disappointing.

That was the case with the figures in the Internal Revenue Service (“IRS”) Whistleblower Office Annual Report for Fiscal Year 2021. However, the newly appointed leadership at the IRS Whistleblower Office apparently also saw the numbers and is taking program actions that have many practitioners excited for the future.

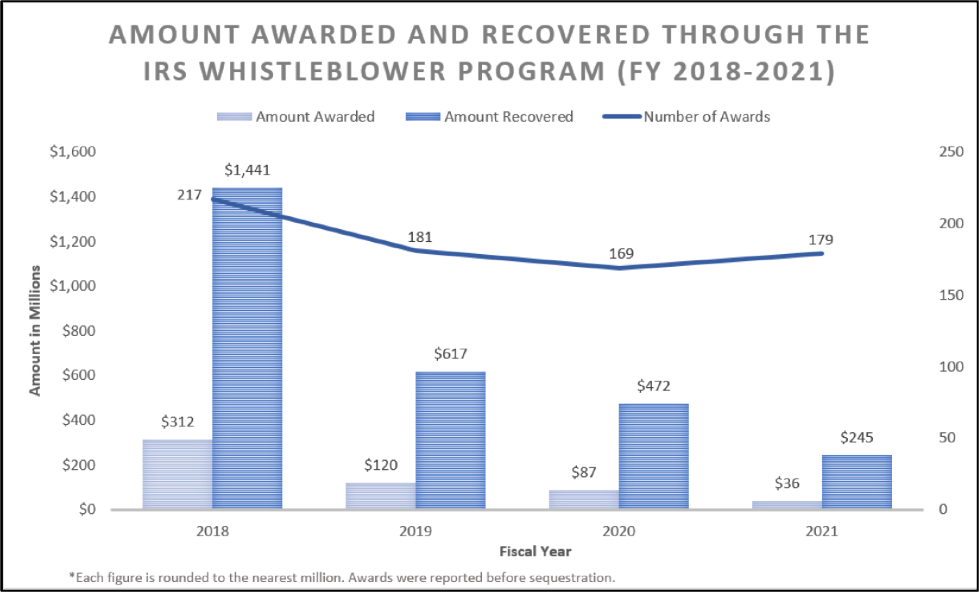

The 2021 Annual Report found that the Whistleblower Office made just 179 awards to tax whistleblowers totaling a little more than $36 million on $245 million in collected proceeds. The lowest numbers generated by the program since 2017.

Perhaps most disturbing, processing times for mandatory award payments also increased by 2.9%. This means the average whistleblower (who gets an award) will wait more than 11 years to receive it. It is hard to imagine anything that undercuts financial incentives more than forcing whistleblowers to wait a decade for an award—except perhaps making them wait eleven years.

To put 2021’s numbers into better perspective, in FY 2018, the IRS Whistleblower Office granted $312 million in whistleblower awards. Granted, that was a record-breaking year, but awards and collected proceeds have significantly declined since then.

Even a record-breaking year is not much when compared to the “Tax Gap,” — the difference between what is owed by American taxpayers and what is actually collected by the IRS.

The IRS Commissioner has spoken extensively about the Tax Gap, citing the figure at $1 trillion per year and saying that the Service lacks the resources to catch non-compliant taxpayers on their own.

If the Tax Gap is that high, the IRS Whistleblower program recouped less than 25 thousandths of a percentage of the Tax Gap last year (.00245%). As an initiative that was developed to shrink tax noncompliance, no observer of the Whistleblower Program’s recent performance would say it’s meeting that mission to full effect.

Yet, the history of the program shows it can work. Since its inception, IRS whistleblowers have helped the U.S. Government collect more than $6.3 billion from non-compliant taxpayers. In turn, more than $1 billion in awards have been made to approximately 2,500 brave whistleblowers.

Recent moves from the IRS Whistleblower Office suggest the new leadership intends to move forward and make improvements and Congress has also proposed legislation to improve the program.

First, John Hinman has stepped in as the IRS Whistleblower Program’s new director. Hinman has a long history with the agency, which to some might indicate “more of the same,” but he has made clear to tax whistleblower practitioners that his staff and fellow Whistleblower Office leadership haven’t taken the latest program numbers lightly.

Indeed, Himan recently hosted the first IRS Whisltelbower Summit to address concerns about the program and get feedback from whistleblower lawyers.

At the October Summit, Director Hinman made clear that the Whistleblower Office was looking to improve how it functions. Perhaps his most impressive proposal was to consider making partial award payments. That would get at least some reward money to whistleblowers in a much shorter time than the eleven year timeframe discussed above, thereby taking a real step to encourage whistleblowers.

The Director also discussed administrative procedures such as how files are reviewed, and how status and stage letter responses are provided.Some of the Director’s proposals were more technical and administrative if not obvious. For example, Hinman broached the idea of filing the initial Whistleblower report form (“IRS Form 211”) electronically, perhaps finally ushering the Office into the deigital age.

This procedure would be similar to the digital submission processes used by the SEC Whistleblower Program sucessfully. Currently the IRS Whistleblower program requires filing such forms with wet signatures by U.S. mail.

Not to be outdone by the Whistleblower office administration, Congress is also looking at legislation to improve the program throughthe “IRS Whistleblower Program Improvements Act of 2021. ”

We are happy to report that Director Hinman committed The Whistleblower office to making the first Whistleblower Program Summit, an “annual” affair.” That should provide the opportunity for practitioners to receive advice on a variety of matters, including how to file quality claims, and also allow a continued opportunity (albeit brief) to provide the IRS with the feedback it will need to help make the program successful.

It will also provide us with an annual opportunity to see if the IRS is making any of the progress it needs to make if it is to have any real impact on closing the tax gap by improving procedures for whistleblowers that, in turn, will lead to more whistleblowers coming forward.

Matthew Beddingfield is a Senior Associate at Zerbe, Miller, Fingeret, Frank & Jadav LP. Tony Munter is an Attorney at Price Benowitz, LLP.