Billions Are Lost to Fraud

Today we’re going to examine the relationship between government expenditures and the amount recovered under the False Claims Act.

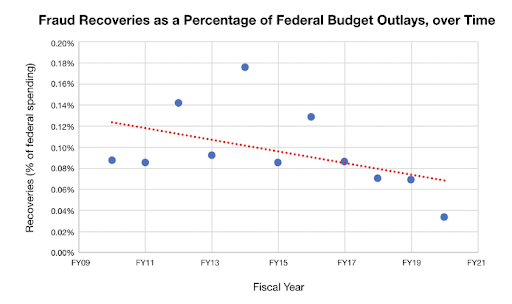

Examining reported numbers since Fiscal Year (FY) 2010, DOJ recoveries under the False Claims Act have remained relatively constant, ranging from $2 billion to $6 billion, while federal spending has been steadily increasing.

In FY11, for instance, the DOJ recovered $3.07 billion under the False Claims Act. Similarly, eight years later, in FY19, the DOJ recovered $3.08 billion. However, federal spending during the same fiscal years shot up by 23%, from $3.60 trillion in FY11 to $4.45 trillion in FY19. And recoveries during FY20 came out to $2.20 billion, the lowest dollar amount since FY08. Meanwhile, federal spending in FY20 was a whopping $6.55 trillion, the highest dollar amount ever.

As a result of this uneven growth rate, fraud recoveries as a portion of federal spending has been, on average, decreasing at a steady rate.

Another surprising fact about recoveries as a portion of federal spending is that they are consistently very low: between 0.03% and 0.18% of total spending, and averaging 0.096% between FY10 and FY20. This is surprising because fraud against the federal government in any given year is estimated to be as high as 7 percent of total spending, according to the Wall Street Journal. Even the government concedes at least 3% is lost to just improper payments, which includes fraud, waste, and abuse.

If we estimate fraud is only 5 percent in 2020 when the federal expenditures totaled $6.55 trillion, taxpayer dollars lost to fraud would be $327.5 billion.

Tomorrow, we will take a closer look at such estimates and quantify the amount that the federal government loses to fraud.