How Fraudsters Are Taking Advantage – of Medicare Advantage

Medicare Advantage (MA), also known as Medicare Part C, is extremely popular. In fact, the Centers for Medicare and Medicaid Services (CMS) recently reported that 2023 was the first year in which a majority of Medicare beneficiaries – 52% — opted for MA instead of traditional, fee-for-service (FFS) Medicare, provided by Parts A and B.

MA was designed to save the Government money. An MA plan annually receives a single per-patient, or capitated, amount of money, which it must use to provide any Medicare health services. FFS, on the other hand, pays doctors and hospitals for each service they perform.

However, since its inception, MA has cost the government more money per-patient. Since 2018, the gap in cost between MA and FFS has quadrupled. In 2024 alone, payments to MA plans are projected to be $83 billion higher than if all MA patients had chosen FFS Medicare.[1]

One reason for the difference is that capitated payments to MA plans are “risk-adjusted,” that is, the annual payment they receive is increased for patients who are diagnosed with additional illnesses. By comparison, FFS Medicare does not change its reimbursement amounts based on how sick a patient is because it is reimbursing per service.

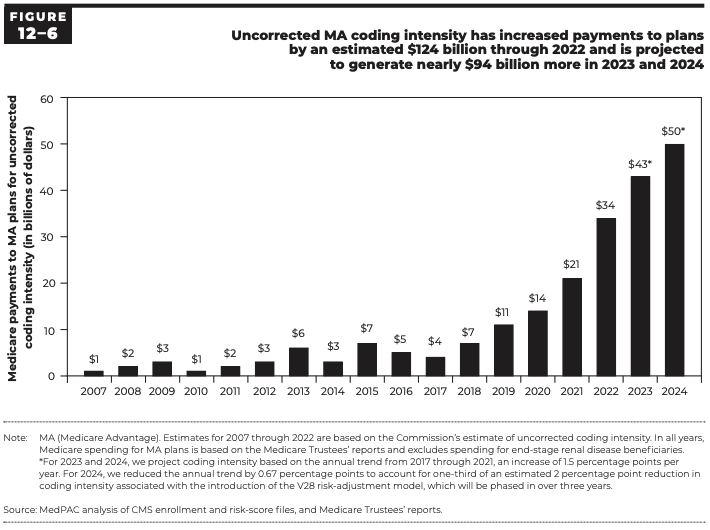

MedPAC has found that MA patients have more reported conditions and receive more diagnosis codes than their FFS counterparts. The increased coding found in MA patients is called “coding intensity.” MedPAC concludes that fully $50 billion of the $83 billion gap projected for 2024will be attributable to “coding intensity” alone.[2] That amount of money could have paid for FFS Medicare coverage for an additional 4.5 million Medicare beneficiaries for a whole year.[3]

The gap caused by “coding intensity” is expanding at an exponential rate, as shown by this chart:

Is fraud causing any part of this disparity? One might think that because doctors diagnose their patients, they would have no incentive to add additional diagnosis codes that would only financially benefit the MA plans. However, MA plan insurers are also permitted by law to add diagnoses to a patient’s chart. The plan insurers themselves can therefore increase their revenues, simply by adding higher-reimbursing diagnoses that the patient’s physician did not place in the patient’s chart.

Consider the practical consequences, to both the patient and the government, of the extra unsupported diagnosis codes that are actually being placed in the patients’ charts:

– The Medicare watchdog, HHS-OIG, reported that after conducting several audits of MA plans through November 2023, it found that fully 70% of the diagnosis codes they reported to CMS were not supported by the patient’s medical record.[4]

– CMS issued a report mandated by the Payment Integrity Information Act of 2019, stating that it estimates it made net overpayments to MA plans in calendar year 2021 totaling $12.7 billion, which is 4.62% of total MA payments for that year.[5] Virtually all of it resulted from the use of diagnosis codes not matched by the patients’ records.

– The Wall Street Journal recently concluded an extensive study comparing MA patients’ diagnoses with those patients’ medical charts for 2018 through 2021, which found that large numbers of patients were never treated for the conditions whose diagnoses were added by their insurers rather than their doctors. For example, the WSJ found that 36,000 MA patients diagnosed by their insurer with diabetic cataracts were never treated for diabetes, and another 66,000 patients were diagnosed with diabetic cataracts even though their cataracts were already removed.

– The Department of Justice’s annual press release for fiscal year 2023 announced that Medicare Advantage fraud is the first type of fraud they are pursuing, stating that the fraud allegations under investigation include MA plans providing “inaccurate information about the health status of beneficiaries enrolled in their plans . . . .”[6]

Adding medically unsupported diagnoses is Medicare fraud, and it is costing the Government billions every year. MA patients and their doctors can help uncover this fraud by paying attention to the diagnosis codes assigned to the patient and blowing the whistle when the coding doesn’t match the reality of the patient’s condition.

Roger Wenthe is the Founder of Roger Wenthe, PLLC

[1] Medicare Payment Advisory Commission (MedPAC), Report to the Congress: Medicare Payment Policy (March 2024), p. 377 Fig. 12-4.

[2] Id.

[3] Based on Medicare Parts A and B spending per beneficiary in 2021 of $11,080, as reported by KFF, an independent organization, based on CMS data. See https://www.kff.org/medicare/state-indicator/per-beneficiary/?currentTimeframe=0&selectedDistributions=medicare-part-a-andor-part-b-program-payments-per-traditional-medicare-enrollee&sortModel=%7B%22colId%22:%22Location%22,%22sort%22:%22asc%22%7D

[4] Office of Inspector General, Department of Health and Human Services, Toolkit: To help decrease improper payments in Medicare Advantage through the identification of high-risk diagnosis codes, p. 1, No. A-07-23-01213 (Dec. 2023).

[5] CMS, Part C Improper Payment Measure (Part C IPM) Fiscal Year 2023 (FY 2023) Payment Error Rate Results

[6] Department of Justice, Office of Public Affairs, False Claims Act Settlement and Judgments Exceed $2.68 Billion in Fiscal Year 2023 (Feb. 22, 2024).