To Combat Customs Fraud, Whistleblowers Remain Crucial

U.S. Customs and Border Protection (“CBP”) is the nation’s largest federal law enforcement agency. As part of their broad mission to secure the nation’s borders, CBP employees juggle myriad responsibilities, including intercepting terrorists and criminals, keeping illegal weapons out of the United States, and managing the flow of visitors and migrants.

Amid these numerous priorities, CBP is also responsible for screening the trillions of dollars of cargo that enter the United States each year. Many of these goods are subject to customs duties, which are intended to protect the United States economy by ensuring that American manufacturers can compete on a fair basis with foreign manufacturers.

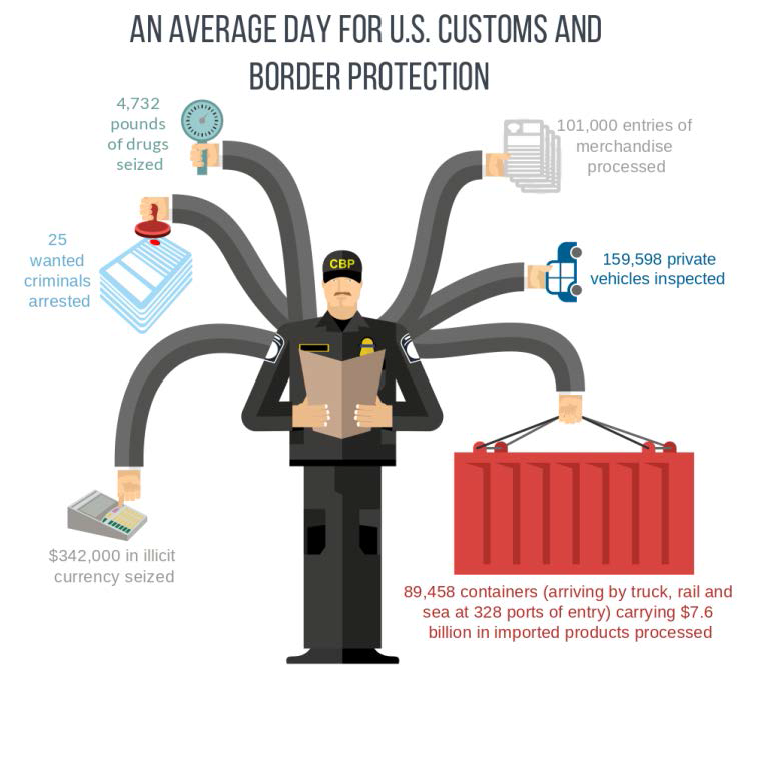

From FY 2019 through FY 2021, CBP received and processed an average of more than 35 million entry summaries each year, relating to goods worth an average of $2.63 trillion annually. On a single average day in FY 2021, CBP processed 89,458 containers arriving by truck, rail, and sea at 328 ports of entry, carrying $7.6 billion worth of imported products.

Even while addressing this deluge of imports, CBP still managed to inspect an average of 159,598 private vehicles, seize 4,732 pounds of drugs and $342,000 in illicit currency, and arrest 25 wanted criminals every single day.

When an importer brings goods into the United States, the importer is required to file paperwork with CBP describing the goods, their country of origin, and their applicable duty rates. CBP processes an average of 101,000 entries of merchandise every day—many of which are dozens of pages long. Amid a torrent of international trade, criminal activity, migration, and numerous other responsibilities, CBP cannot possibly scrutinize every entry summary. Although most importers abide by the honor system, fraudsters sometimes are able to take advantage of CBP’s limited resources to avoid paying what they owe. Fortunately, whistleblowers can help fill the gap by revealing the fraudulent schemes these importers use to avoid paying their fair share.

Now more than ever, whistleblowers are essential to assist CBP in enforcing customs laws. In recent years, punitive trade measures, largely against China, have disrupted nearly every industry that relies on international trade. Most importers have willingly complied with the law, paying the additional customs duties and tariffs associated with their goods or shifting their operations away from China and to other countries that are not subject to punitive trade measures. However, not everyone plays by the rules, and unscrupulous importers have defrauded the government out of billions of dollars. For example, in August 2021, CBP reported that importers owed $3.54 billion in unpaid antidumping and countervailing duties on goods from China as of FY 2020.

This figure—which represents only the unpaid bills that CBP knows about—only scratches the surface of the true extent of customs fraud. As fraudsters develop increasingly sophisticated schemes to disguise their products’ countries of origin and duty classifications, whistleblowers will remain one of the government’s most important tools in the fight against fraud.

Written by Noah Rich of Baron & Budd. Edited by James King of Taxpayers Against Fraud. Fact checked by Julia-Jeane Lighten of Taxpayers Against Fraud.