There’s Billions in “Other” Frauds Outside of Healthcare and Defense Contracting

Healthcare and defense spending rank number 1 and 2 in the federal budget every year. It is not surprising that they would similarly take top-billing in fraud recoveries. As described on September 1, DOJ issues an annual report detailing statistics on its FCA recoveries. DOJ’s report breaks recoveries into three groups: “Health and Human Services,” Department of Defense,” and “Other.” But what exactly is “other”? What makes up this non-descript “catch-all” category and how big of a line item in the federal budget does it represent?

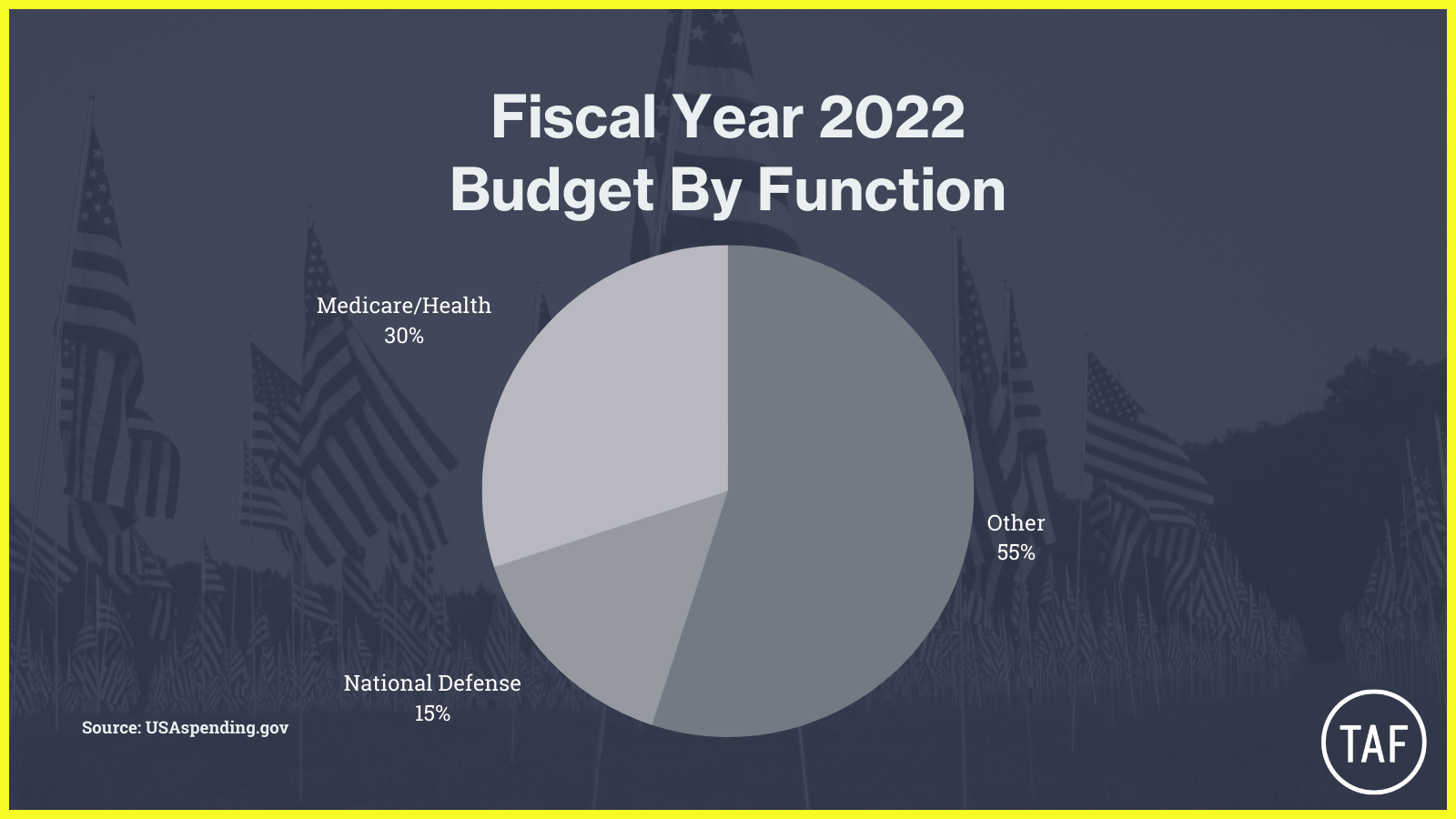

The answer is a lot of things fall under the “other” umbrella. Most importantly, the government spends a lot of money on “other” things besides defense and healthcare. In fact, the government spends more than half its annual budget on “other.”

According to USAspending.gov, the federal government will spend $7.2 trillion on “all budget functions” in fiscal year 2022. Of this, 16.3% ($1.2 trillion) will go to Medicare, $13.6% ($977 billion) will go to “Health” functions (including Medicaid and SCHIP), and 14.6% ($1 trillion) will go to “National Defense” (including the Department of Defense). That leaves 55.4%—about $4 trillion—for “other” government functions.

What’s covered by this $4 trillion? A LOT. As President Biden said in releasing his 2022 budget, “[w]here we choose to invest speaks to what we value as a Nation.” And our spending illustrates the wild, wacky, weird, and wonderful aspects of America.

For example, in FY 2022, we will spend:

- $1.1 trillion on social security payments to provide a safety net for the disabled and elderly;

- $232.5 billion in Veterans benefits and services;

- $166 billion on food and nutrition assistance;

- $118 billion to the Highway Trust Fund to build and maintain roads;

- $70.7 billion on higher education including $45 billion on direct student loans;

- $57 billion on disaster relief and insurance;

- $29 billion on international development and humanitarian assistance;

- $19.6 billion on “space flight, research, and supporting activities”;

- $14 billion to fund Customs and Border Protection;

- $9.5 billion to the Federal Aviation Administration;

- $3 billion for wildland fire management;

- $684 million to the Bureau of Engraving and Printing;

- $224 million to the National Endowment for the Arts;

- $194 million on the National Agricultural Statistics Service; and

- $142 million for the civil Corps of Engineer to remediate former nuclear energy sites.

We have already talked about various ways in which some of these programs are vulnerable to fraud. The Government Accountability Office estimates that federal agencies made $281 billion in improper payments in FY 2021 (excluding improper payments related to COVID-19 relief funding). This covers fraud, waste, and abuse, but also fails to fully account for the full scope of improper payments, because of a lack of “complete, reliable, or accurate estimates.” Given that “other” programs account for more than 50% of the federal budget, GAO findings, and consistent False Claims Act recoveries in these “other” areas, there may be substantial fraud impacting many of our programs to fund the arts, build roads, go to space, and even print money.

Department of Justice lawyers have expressed their desire to pursue fraud cases outside of the well-worn paths of healthcare and defense cases. In its announcement of FY 2021 recoveries, the Department took pains to call out successes in the procurement space and in “other” actions related to natural gas production, underpayment of customs duties, the FCC’s E-Rate program, federal education initiatives, and mortgage fraud.

There is no question that “other” fraud is abundant and that whistleblowers are a key component in the successful pursuit of “other” fraud on the government. Since FY 1987 (the beginning of the Department’s FCA recovery statistics), qui tam cases have led to 76% of recoveries in the healthcare space (and have accounted for 87% of the cases brought). At the same time, qui tam cases have comprised a substantial, but notably lower, percentage of recoveries (49%) and cases (56%) in the “other” category.

Healthcare and Defense Fraud may grab the headlines. But the numbers make clear that the government’s significant expenditures that get lumped into the “other” category are also vulnerable to fraud – and equally in need of whistleblowers to help the government expose the fraudulent schemes that take money from the diverse programs caught in this “Catch All.”

Written by By Molly Knobler of Phillips & Cohen LLP. Edited by Kate Scanlan of Keller Grover LLP and Tony Munter of Price Benowitz. Fact checked by Julia-Jeane Lighten of Taxpayers Against Fraud.