Pill Talk: Negotiating, Lobbying, and Inflating Drug Prices

The government spends a lot of money on Medicare and Medicaid. And the numbers are only getting larger. By 2030, it is projected that Medicaid spending will exceed $700 billion. A massive portion of this spending goes towards prescription drugs. How did we get here, and is it possible to reduce the government spending?

Pharmacy Benefit Managers (“PBM”) laud their work as a method for reducing prescription costs by acting as middlemen between drug manufacturers and insurance providers. One PBM lobbyist firm reported that PBMs save patients an average of $1,040 per year. Further, PBMs reportedly save patients 40-50% on drug and medical costs.

PBMs were originally created in the 1960s to process insurance company claims and have since grown to play a massive role in pharmaceutical pricing and healthcare. In 2012, PBMs processed under 50% of prescriptions in the United States, and by 2023, that number had grown to 80% of all prescriptions in the US.

As PBMs have taken a more active role in the market, the cost of drugs has actually increased. In 2022, the U.S. government spent approximately $406 billion on prescription drugs. From 2000 to 2020, the government increased its spending on drugs by 91 percent.

There are a few reasons why drug prices have increased at such a rapid rate. First, PBMs often inflate prescription prices as compared to prices charged by wholesalers. For example, one cancer patient was overcharged more than $120,000 for a year of his cancer drug, according to insurance documents.

Next, the pharmaceutical industry influences the structure of healthcare laws. At the end of August 2024, the Justice Department brought a case alleging that the government had proposed a regulation to prevent insurance companies overcharging federal programs, like Medicare Advantage, but backed away after “stakeholder concern and pushback.”

The above issues, combined with fraud throughout the healthcare industry, greatly impact the price of drugs. Of the $2.68 billion recovered in settlements and judgments under the False Claims Act in fiscal year 2023, approximately $1.8 billion related to the healthcare industry.

The Federal Trade Commission initiated an investigation into PBMs for potential antitrust violations in 2022. In July 2024, the FTC released its interim investigation report, finding that there are several ways in which PBMs drive up prescription drug costs, including encouraging patients to choose more expensive drugs from “specialty pharamcies.”

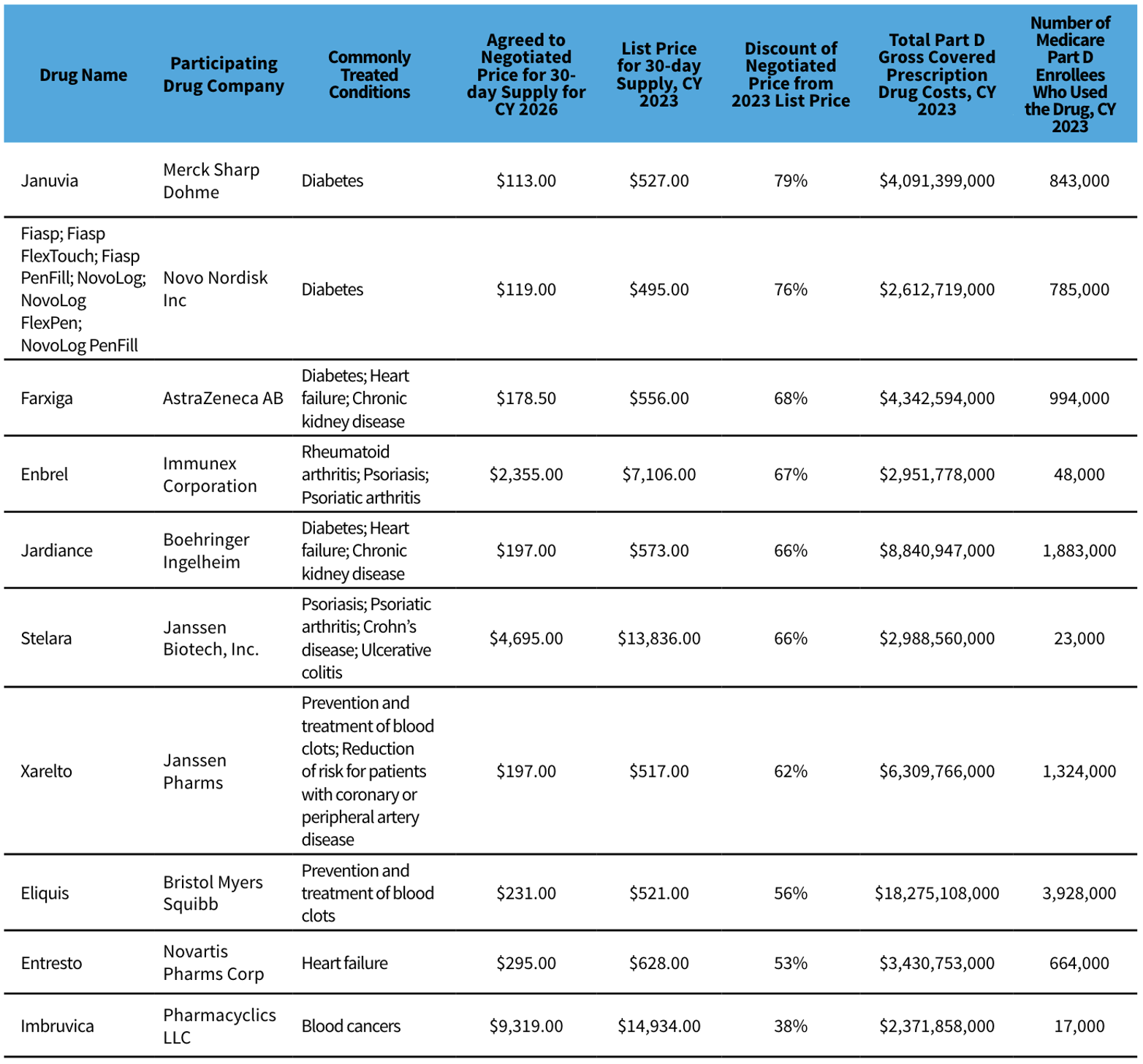

In response to the high cost of prescriptions, the government passed the Inflation Reduction Act, to enable government to negotiate with pharmaceutical companies over the prices of certain Medicare Drugs. The Department of Health and Human Services (“HHS”) recently unveiled negotiated prices for ten Medicare Drugs that were between 38 and 79 percent lower than the original market price. (See the table below.) The reduction for these ten drugs is predicted to save patients a projected $1.5 billion in the first year. Additionally, the government will save an estimated $100 billion five years after the new drug prices are enacted.

The government is also investigating PBMs and bringing lawsuits against companies that report improper pharmaceutical pricing and improperly bill the government for prescriptions. On September 20, FTC took legal action against three PBMs – CV Health’s Caremark, Cigna’s Express Scripts and UnitedHealth’s Optum Rx — for artificially inflating the price of insulin.

Inflation is on everyone’s mind these days. When it comes to prescription drug costs, the government is finally taking steps to keep these costs under control.

Grace Swindler is Director of Legal Education at The Anti-Fraud Coalition