Based on Past, DOJ’s New Whistleblower Program Could Yield Big Recoveries for Taxpayers

The Department of Justice (DOJ) recently unveiled a new whistleblower program, the Criminal Division Corporate Whistleblower Awards Pilot Program, on August 1, 2024. This new program enables eligible whistleblowers who report information about corporate and financial misconduct potentially to receive an award from the resulting forfeiture. The new program is designed to fill gaps that the False Claims Act and pre-existing whistleblower programs, like the IRS, SEC, and CFTC whistleblower programs, do not cover.

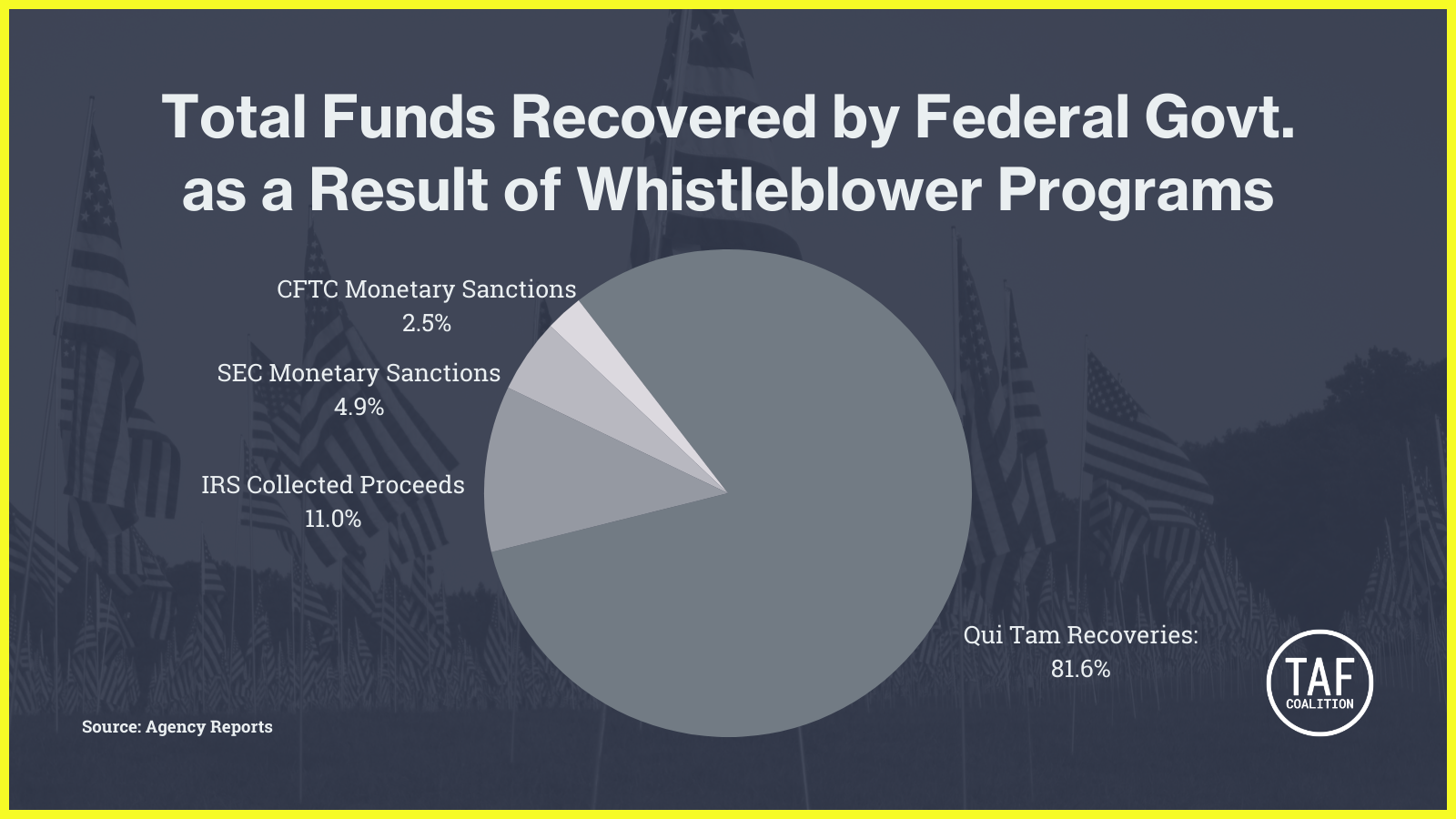

The cadre of other successful whistleblower programs that the new Criminal Division Corporate Whistleblower Awards Pilot Program joins show how whistleblowers protect the public fisc. Their efforts have resulted in the recovery of over $69 billion dollars in funds by the federal government since the modern False Claims Act came into existence in 1986. These whistleblower programs have proven to be an enormous boon for taxpayers. In piloting a new program, DOJ seeks to expand the benefits of these whistleblower programs by opening up more channels for recovering and returning funds to the federal treasury.

In total, recoveries from lawsuits brought by whistleblowers under the federal False Claims Act–known as “qui tam” lawsuits–have totaled over $5.2 billion dollars since 1986. Collected proceeds resulting from whistleblower tips submitted to the IRS Whistleblower Program have totaled over $7 billion dollars. The SEC’s Whistleblower Program has recovered $6.3 billion in monetary sanctions as a result of whistleblowers, while the CFTC’s Whistleblower Program has recovered $3.2 billion as a result of whistleblowers.

Some much newer whistleblower programs have yet to report how much money has been recovered as a result of whistleblower tips. For example, the whistleblower program administered by FinCEN has yet to report on funds collected as a result of whistleblowers.

The Criminal Division Corporate Whistleblower Awards Pilot Program seeks information involving four areas of violations including money laundering by financial institutions; foreign corruption and bribery by companies; kickbacks made to domestic federal, state, and local public officials and government officers and employees; and fraud involving private or non-public health care programs, or against patients, investors, or other non-governmental health care entities, or any other healthcare related violations not covered under the False Claims Act.

Despite the proven success of whistleblower reward laws and programs, there have been limits on what kinds of fraud whistleblowers could report and get an award. Indeed, some of the greatest successes so far have come through whistleblower cases filed under the False Claims Act involving health care fraud, but those cases are limited to fraud against government programs such as Medicare, Medicaid, or Tricare. Consequently, these cases can only directly impact programs affecting the 119 million people covered by government insurance programs and do not extend to fraud affecting health care and insurance for the approximately 216 million Americans covered by private health insurance. The new DOJ initiative has the potential to collect funds and enforce health care laws and regulations that affect the millions of people who are dependent on private insurance too.

Emily Stabile is a Partner at Phillips & Cohen