Looking at $3.2 Trillion in State & Local Government Spending

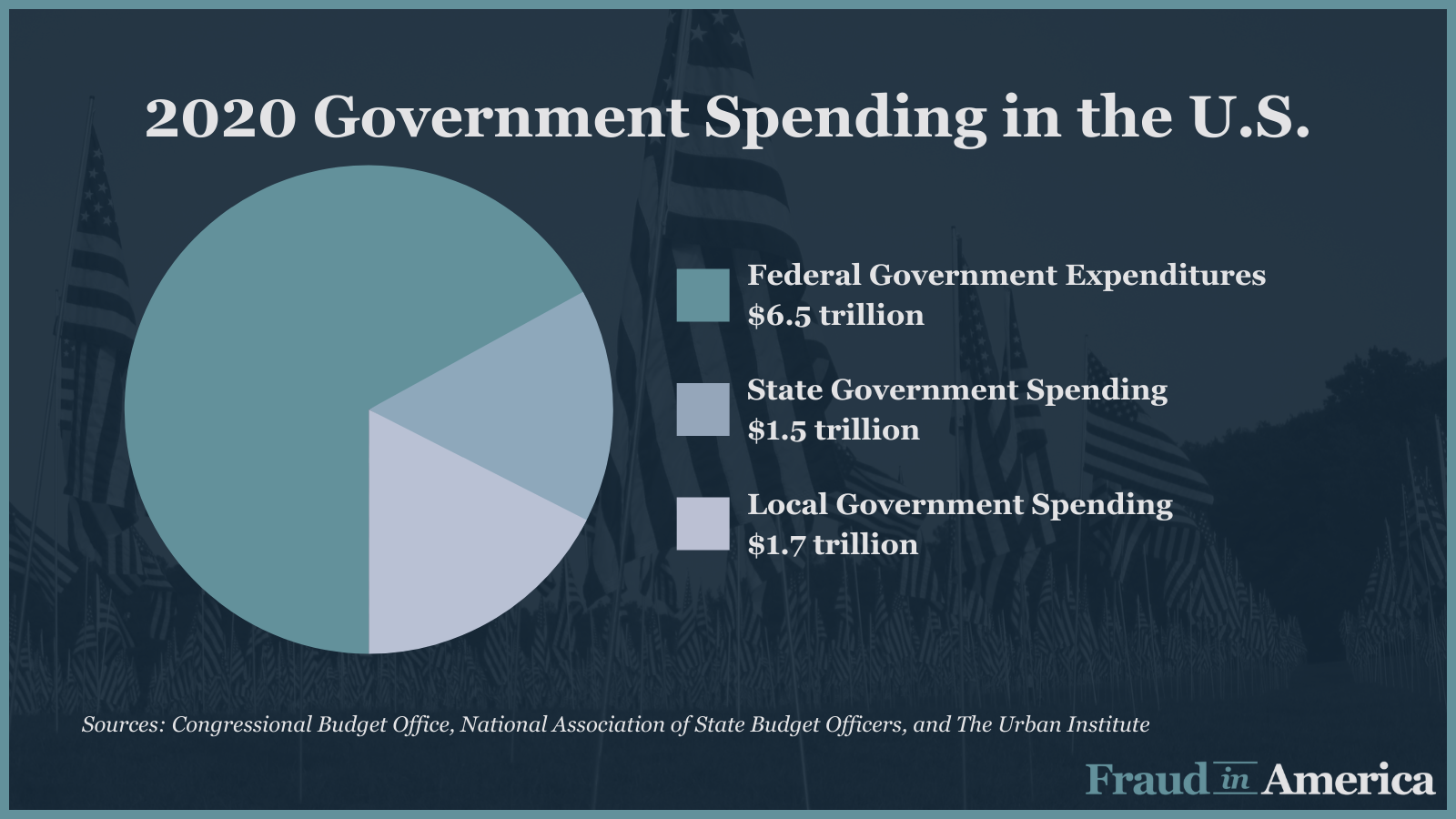

In the United States, a substantial portion of government functions are carried out by state governments. In fiscal year 2019, the total amount of state government spending (including all 50 states and the District of Columbia) was about $1.5 trillion. This is about 7% of the U.S. GDP, less than the federal government’s 20% share but still sizable. Were they combined, U.S. state government expenditures would be greater than the central government expenditures of any European country.

States have different responsibilities than the federal government, although the federal government subsidizes state programs in many ways. The largest program paid for by the states is Medicaid (health insurance for people with lower incomes). The states pay for about 36% of Medicaid, with the rest paid for by the federal government.

Since the creation of Medicaid and its shared state-federal funding structure in 1965, Medicaid has been a growing share of the state’s fiscal burden, with about 16% of the $1.5 trillion in state government spending going to Medicaid. Other important responsibilities of the states are elementary and secondary education (24.5%), higher education (13%) and transportation (8.3 %).

The $1.5 trillion state government spending figure does not include local government spending, which is an additional $1.7 trillion. This can be a complicated distinction, as “local” means different things in different states, but typically refers to municipal governments that are distinct entities from the state governments.

Local governments usually take on different responsibilities from state governments—the most important of which is usually the K-12 public school system, which is 40 percent of total local government spending—but also share health spending with the state and federal government through direct spending on public hospitals.

The $3.2 trillion in state and local spending represents an enormous amount of government spending that is vulnerable to fraud.

At least 30 states and the District of Columbia have passed their own state False Claims Acts to recover money lost to fraud. Of these laws, 8 only cover Medicaid. Of the state FCAs that cover all state government spending, the U.S. Department of Health and Human Services judges only 12 to be as strong as the Federal False Claims Act.

Local governments can be sued under the federal and some state False Claims Acts themselves, but they can also be victims of fraud, and are increasingly implementing their own False Claims Acts.

Later this month, we will explore how whistleblowers using the state False Claims Acts are helping recover critical state funds.

Written by Nicolas Mendoza of Murphy Anderson PLLC